[ad_1]

Three quarters of Gen Z Americans are renters. That’s partly because buying a home is harder for the young generation—whose oldest members are 27—than it was for other US citizens in their early adult years. The financial difficulties associated with inflation and the rising cost of student debt have only made things worse.

To even the scales, members of Gen Z have pushed to have rental payments count toward their credit scores like mortgage payments. Apparently, Zillow has taken notice.

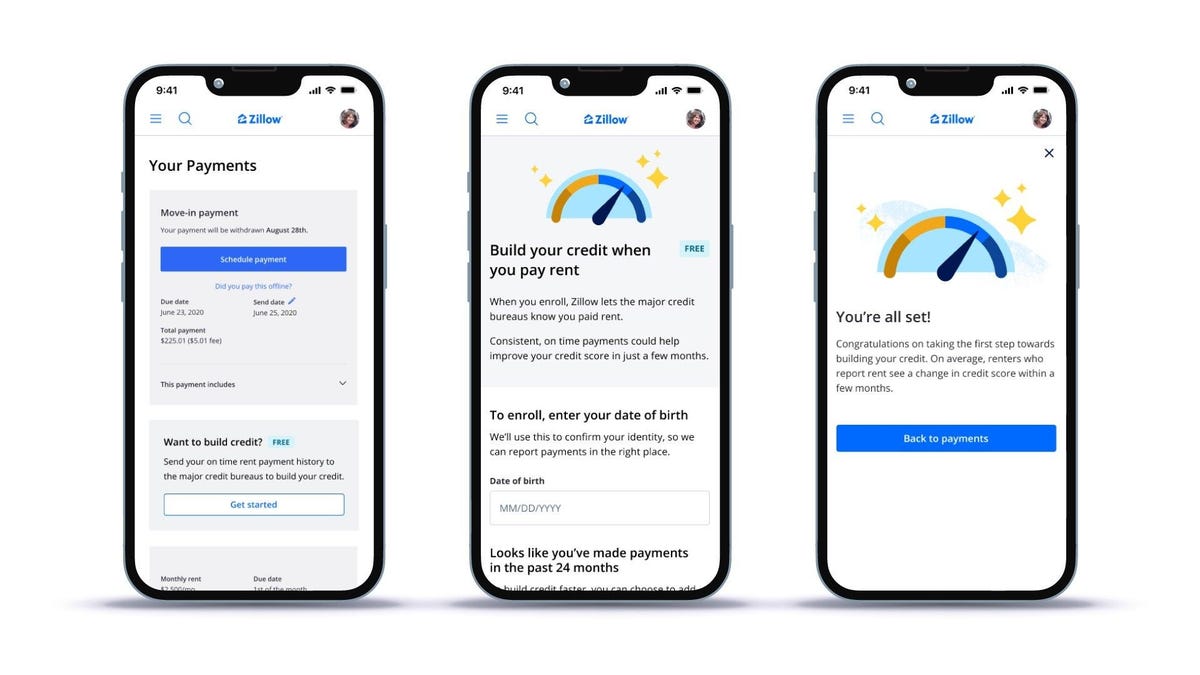

The online real estate marketplace announced Wednesday (Jan. 17) that it will allow renters who pay through the platform to have their on-time payments reported to Experian, one of the big three credit bureaus.

Tens of thousands of renters across all 50 states currently pay rent via Zillow, the company told Quartz, declining to give specific estimates.

“Zillow’s rent reporting program is rooted in the recognition of a significant gap in credit reporting,” the company said in a statement. “Despite renters in the U.S. spending hundreds of billions annually on rent, these substantial payments often aren’t reported.”

Credit reports seldom show rent payments

It’s true—rent payments rarely make it onto credit reports.

“Historically speaking, rent has never been on credit reports,” John Ulzheimer, a credit expert who previously worked at FICO and Equifax, told Quartz. “And unfortunately, that’s a hard habit to break.” Companies and landlords would have to take on extra costs to comply with the Fair Credit Reporting Act, such as adding employees to manage the process, Ulzheimer said.

A number of rent-reporting services are available to renters, but the system is “decentralized,” said Amy Wipfler, the product manager behind Zillow’s new payment reporting tool. Zillow is the first large online rental marketplace to report such data to a major credit bureau.

In the current landscape, in the rare case that rent payments do make it to consumer credit reports, they typically help rather than hurt credit scores. During a pilot program run by Fannie Mae from 2022 to 2023, some 300,000 tenants saw their credit scores rise an average of 40 points when their rent payments were included.

“Rent payment trade lines are a really valuable way to build credit because, unlike other credit trade lines, it doesn’t require opening a line of debt,” Wipfler said. “But it’s very similar in that you’re agreeing to a lease duration, you’re committing to something, and then you’re paying it every month.”

Renters must pay their landlord through Zillow to use its new feature, and Wipfler told Quartz that renters can “refer their landlords” to use Zillow Payments (its rental manager platform) if they don’t already. Zillow emphasized that its new feature is free for landlords to use.

The uphill battle to making rent payments count

While Ulzheimer says Zillow’s program is a start, he argues that both on-time and late rent payments would need to be reported to all three major credit bureaus for the data to make a difference. That’s because the companies that buy credit reports—banks, credit card issuers, auto lenders, and others—can ask credit bureaus to leave out certain data if they don’t think it’s reliable. “So, even though [rent payment data] may be reported, it doesn’t necessarily mean that it’s always going to be present on a credit report.”

Also, some FICO scoring models don’t consider rental payment data when calculating credit scores. Meanwhile, newer versions of FICO (FICO9 and FICO10), as well as VantageScore, include the data in scores.

To be sure, Zillow’s program controls for renters who make consistently late payments by automatically unenrolling those with three late payments in a row.

A step in the right direction

While not flawless, Zillow’s new option signals a broader shift toward expanding credit-building opportunities for younger and historically marginalized Americans, who typically have less access to credit.

Ulzheimer says the move is a “step in the right direction.” And Zillow told Quartz it hopes to report to all three major credit bureaus (Equifax and TransUnion too) as soon as possible.

[ad_2]

Source link